you position:Home > stock coverage > stock coverage

US Stock Earnings Reports: The Key to Market Insights

![]() myandytime2026-01-19【us stock market today live cha】view

myandytime2026-01-19【us stock market today live cha】view

info:

In the ever-evolving world of stock markets, US stock earnings reports are the cornerstone of investor decision-making. These reports provide a comprehensive overview of a company's financial health, offering insights into its performance and future prospects. Understanding these reports can significantly enhance your investment strategy.

What Are US Stock Earnings Reports?

At their core, US stock earnings reports are documents released by companies after the end of each fiscal quarter. They detail the company's financial performance, including revenue, profits, and other key metrics. These reports are crucial for investors as they provide a snapshot of the company's current financial health and future growth potential.

Key Components of US Stock Earnings Reports

- Revenue: This is the total amount of money a company earns from its operations. It's a critical indicator of a company's overall performance.

- Earnings Per Share (EPS): This is the company's profit divided by the number of outstanding shares. It's a key measure of a company's profitability.

- Net Income: This is the company's total profit after all expenses and taxes are deducted.

- Profit Margin: This measures how much profit a company makes for every dollar of revenue.

- Revenue Growth: This indicates how much the company's revenue has increased over a specific period.

How to Analyze US Stock Earnings Reports

Analyzing US stock earnings reports involves a few key steps:

- Compare to Previous Reports: Look at how the current report compares to previous quarters. Has the company's revenue and EPS increased, or have they decreased?

- Compare to Industry Benchmarks: Compare the company's performance to its peers in the same industry. This can provide insights into how the company is performing relative to its competitors.

- Look for Trends: Look for trends in the company's financial performance over time. Are there any signs of improving or declining profitability?

Case Study: Apple Inc.

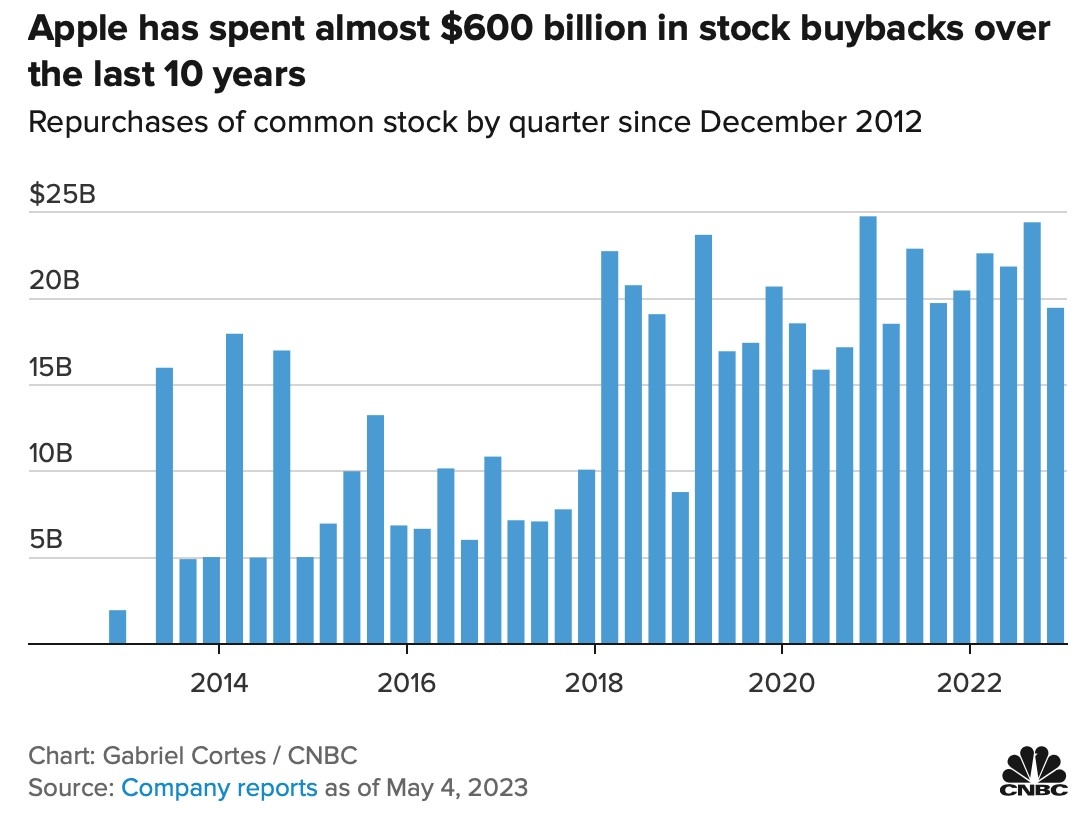

Consider Apple Inc., one of the most successful companies in the world. In its latest earnings report, Apple reported record revenue and EPS. This was driven by strong sales of its iPhone and other products. However, investors were also concerned about the company's slowing revenue growth in some regions. This example illustrates how US stock earnings reports can provide both positive and negative insights.

Understanding Earnings Reports in Context

It's important to remember that US stock earnings reports are just one piece of the puzzle. Other factors, such as economic conditions and industry trends, can also impact a company's performance. Therefore, it's crucial to analyze earnings reports in the context of the broader market and economic landscape.

Conclusion

In conclusion, US stock earnings reports are a vital tool for investors looking to make informed decisions. By understanding the key components of these reports and how to analyze them, investors can gain valuable insights into a company's financial health and future prospects. Whether you're a seasoned investor or just starting out, understanding US stock earnings reports is a crucial step in your investment journey.

so cool! ()

like

- Are US Bank Stocks a Buy?

- Impact of US Government Shutdowns on Stock Market: Historical Data Analysis

- Expected Rate of Return in the US Stock Market: What Investors Should Know

- "US Rate Cut: How It Impacts Japanese Stocks"

- Latest US Stock Market News August 10, 2025

- "Geely US Stock: A Comprehensive Analysis and Investment Opportunities&a

- Top Performing US Stocks Over the Past 5 Years: A Deep Dive

- Chart of the US Stock Market by President: A Decade-by-Decade Analysis

- Kato Rabe N Scale US Shop: Your Ultimate Destination for In-Stock Models

- "Best Performing US Stocks in 2015: Top 5 Investments to Watch"

- Unlocking Potential: A Deep Dive into US Medical Company Stocks

- US Express Stock: NYSE's Rising Star

hot stocks

IEA Global EV Outlook 2021: US Electric Vehicl

IEA Global EV Outlook 2021: US Electric Vehicl- IEA Global EV Outlook 2021: US Electric Vehicl"

- Best Performing US Stock Market Sectors in 202"

- Best Stocks to Invest in the US Now: Top Picks"

- Magnificent 7 US Stocks 2023 Performance: Top "

- Undervalued US Growth Stocks: Unlocking Hidden"

- ATVI US Stock: A Comprehensive Guide to Unders"

- "http stocks.us.reuters.com stocks fu"

- "Impact of Covid-19 on the US Stock M"

recommend

Are US Bank Stocks a Buy?

Are US Bank Stocks a Buy?

"Is the US Stock Market Open on Colum

Unlock the Potential of US Hala Stock: A Compr

Best Performing Large Cap US Stocks Past Week:

Stock Market News Tomorrow: What You Need to K

T-Mobile US to Give Stock to Customers: Revolu

"Google's US Stock Performance:

"http stocks.us.reuters.com stocks fu

Defense Stocks: A Solid Investment in the US

Not Buy Thinly Traded Stocks: A Wise Investmen

Ianthus Stock Price: A Comprehensive Analysis

tags

-

AllegedNon-USOpenHolidaysDelekSmallPurchaseBYDEarthClosedGoldEssentialCanTomorrowLNGChineseComprehensUnderstaGrowingRareFuturesAprilHolSchwabManyJonesDefinitiofromIndianMFCDaysTotalFoodSixth-GenerBogleheFallCitizensNintendoDidListTimings100verutodshareamerican10miniliveShausaTarCleanasdaqequityratioTraPriLucrRegSmarspreadHoldingToOptCom2022UnveilinaverageUndertodayFuCorreTradETPharmacequantitativeGaFuturSustainaAvGuidWhisBroadcFindLloanEarningcolacoca us stocks games silver etf us stock

like

- AK-74 US Stock Set: A Comprehensive Guide to E"

- Reasons for Us Stock Market Moves June 2025"

- US Express Stock: NYSE's Rising Star"

- Understanding the Stock Market Regulations in "

- How Large Is the US Stock Market?"

- Stocked Cheese US: A Comprehensive Guide to th"

- Not Buy Thinly Traded Stocks: A Wise Investmen"

- Unlocking Opportunities in Health Care Stocks:"

- How to Invest in US Stocks Through Zerodha: A "

- "Name the US Stock Exchange: A Compre"