you position:Home > new york stock exchange > new york stock exchange

Buy Us Treasury Stocks: A Strategic Investment Move

![]() myandytime2026-01-19【us stock market today live cha】view

myandytime2026-01-19【us stock market today live cha】view

info:

Investing in U.S. Treasury stocks is often overlooked as an investment opportunity, but it can be a wise choice for those seeking stability and steady returns. In this article, we will delve into the reasons why buying U.S. Treasury stocks might be a strategic investment move for you.

Understanding U.S. Treasury Stocks

U.S. Treasury stocks are essentially shares of ownership in the U.S. government. When you purchase these stocks, you are essentially lending money to the government, which they promise to repay with interest over a specified period. These stocks are considered to be among the safest investments in the world due to the backing of the U.S. government.

The Benefits of Buying U.S. Treasury Stocks

Safety and Security: One of the primary benefits of investing in U.S. Treasury stocks is their high level of safety and security. Unlike stocks in the private sector, U.S. Treasury stocks are backed by the full faith and credit of the U.S. government. This means that your investment is less likely to be affected by market volatility or company-specific issues.

Stable Returns: U.S. Treasury stocks typically offer stable returns over time. While these returns may not be as high as those from riskier investments, they are more predictable and consistent. This can be particularly appealing to investors who prioritize capital preservation over high returns.

Dividend Income: Many U.S. Treasury stocks pay dividends to shareholders. These dividends can provide a steady stream of income, which can be especially beneficial for retired investors or those relying on investment income to cover living expenses.

Diversification: Including U.S. Treasury stocks in your investment portfolio can help diversify your risk. Since these stocks are not correlated with the stock market, they can provide a buffer against market downturns.

How to Buy U.S. Treasury Stocks

Buying U.S. Treasury stocks is relatively straightforward. You can purchase them through a brokerage account or directly from the U.S. Treasury. Here’s a step-by-step guide:

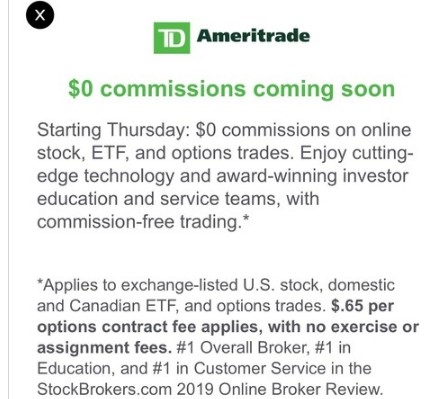

Open a Brokerage Account: If you don’t already have a brokerage account, you’ll need to open one. Many online brokers offer commission-free trading, making it easier and more cost-effective to invest in U.S. Treasury stocks.

Fund Your Account: Transfer funds from your bank account to your brokerage account to have the necessary capital to buy U.S. Treasury stocks.

Research and Choose: Research the different types of U.S. Treasury stocks available, such as Treasury bills, notes, and bonds, and choose the ones that align with your investment goals and risk tolerance.

Place an Order: Once you’ve selected the U.S. Treasury stocks you want to buy, place an order through your brokerage account. You can choose to buy shares directly from the U.S. Treasury or through a broker.

Case Studies

One example of a successful investment in U.S. Treasury stocks is the purchase of Treasury Inflation-Protected Securities (TIPS). TIPS are a type of U.S. Treasury security that adjusts for inflation. During the 2008 financial crisis, many investors turned to TIPS for their inflation protection and stability, leading to significant gains for those who held onto their investments.

Another example is the purchase of Treasury bonds during times of economic uncertainty. During the 2020 COVID-19 pandemic, investors sought the safety of U.S. Treasury bonds, leading to higher bond prices and increased returns for those who invested during that period.

Conclusion

Buying U.S. Treasury stocks can be a strategic investment move for those seeking stability, steady returns, and diversification. While these investments may not offer the highest returns, their safety and security make them a valuable component of any well-diversified investment portfolio.

so cool! ()

like

- Total Market Capitalization: The Size of the US Stock Market

- Ticker Tape for US Stocks: A Comprehensive Guide

- Top Performing US Large Cap Stocks Over the Past 5 Trading Days

- Greenbrier Companies: A Leading Force in US Railroad Stocks

- Can F1 Visa Holders Invest in the US Stock Market?

- Stock Symbol for US Treasury Bonds: A Comprehensive Guide

- Can You Buy Nintendo Stock in the US? A Comprehensive Guide

- 2025 April 30th: A Deep Dive into the US Stock Market News

- US Dollar vs. Emerging Markets Stocks: A Comprehensive Analysis

- Stock Trade Transactions in the US: A Yearly Overview

- Best US Stock to Invest In for 2023: Top Picks and Analysis

- Can a Foreigner Buy U.S. Stocks? A Comprehensive Guide

hot stocks

HSBC US Stock Trading Fees: What You Need to K

HSBC US Stock Trading Fees: What You Need to K- HSBC US Stock Trading Fees: What You Need to K"

- Top Momentum Stocks in the US Market August 20"

- Unlocking Opportunities with US Small Value St"

- Shionogi Stock US: A Comprehensive Analysis of"

- Unlocking the Potential of Barclays Bank US St"

- Does MGM Macau Affect MGM Stocks in US?"

- Unlock the Power of Free US Stock Data: Your U"

- "Can US Residents Open a Stock Accoun"

recommend

Total Market Capitalization: The Size of the U

Total Market Capitalization: The Size of the U

Unlock the Power of Stock Screener US: Your Ul

Independence Realty Trust: A Leading Player in

Invest 10,000 in US Stock Market in 1950: What

"Free Us Stock Trading: How to Maximi

US Crude Oil Stock Forecast: Insights and Pred

Alexion Pharmaceuticals: A Leader in US Biotec

Top Short Term Momentum Stocks in the US: Your

Current CAPE Ratio: A Deep Dive into the US St

Enbridge Stock: A Comprehensive Guide to Inves

Stock Trade Transactions in the US: A Yearly O

tags

-

AllegedNon-USOpenHolidaysDelekSmallPurchaseBYDEarthClosedGoldEssentialCanTomorrowLNGChineseComprehensUnderstaGrowingRareFuturesAprilHolSchwabManyJonesDefinitiofromIndianMFCDaysTotalFoodSixth-GenerBogleheFallCitizensNintendoDidListTimings100verutodshareamerican10miniliveShausaTarCleanasdaqequityratioTraPriLucrRegSmarspreadHoldingToOptCom2022UnveilinaverageUndertodayFuCorreTradETPharmacequantitativeGaFuturSustainaAvGuidWhisBroadcFindLloanEarningcolacoca us stocks games silver etf us stock

like

- HSBC Stock Price US: Key Factors and Future Ou"

- The End is Nigh for Us Stocks? A Deep Dive int"

- Understanding U.S. Stock Market Holidays: What"

- Can You Buy CATL Stock in the US?"

- Food Company Stocks: The Ultimate US Investmen"

- Buying a Canada Stock Based in the US: What Yo"

- "How Many Stock Markets Are There in "

- Maximize Your Investment Potential with Etoro "

- Samsung Vendor List: Companies on the US Stock"

- Energy Sector Stocks: A Comprehensive Guide fo"