you position:Home > can foreigners buy us stocks > can foreigners buy us stocks

Outlook on US Stocks: The Future is Bright but Challenges Remain

![]() myandytime2026-01-19【us stock market today live cha】view

myandytime2026-01-19【us stock market today live cha】view

info:

The stock market has always been a hot topic for investors and financial analysts alike. As we delve into the current landscape, it's important to take a closer look at the outlook on US stocks. While the future seems promising, there are several challenges that investors need to be aware of. This article will explore the key factors that could impact the US stock market and provide valuable insights for investors.

Economic Growth and Corporate Profits

One of the primary drivers of the US stock market is economic growth and corporate profits. The U.S. economy has been on a strong uptrend over the past few years, with low unemployment and rising consumer spending. This has translated into higher corporate profits, which have, in turn, boosted stock prices.

Tech Giants and Innovation

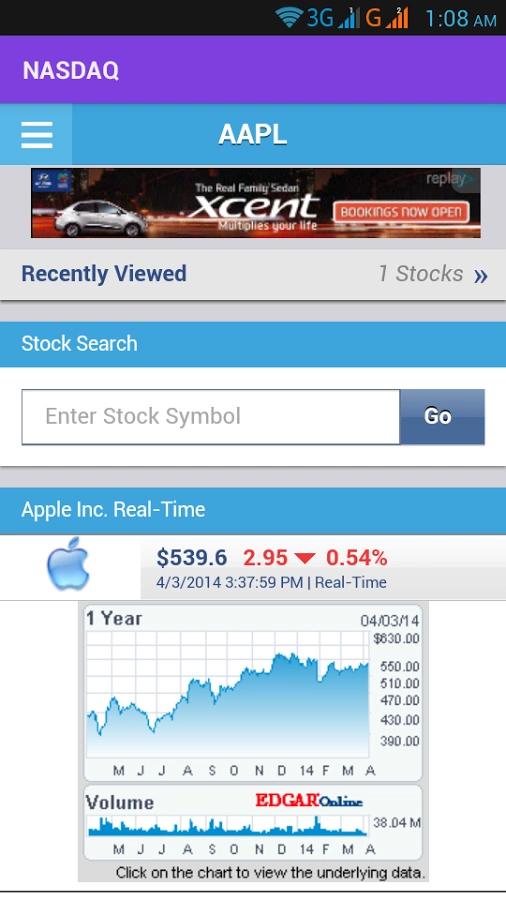

The technology sector has been a significant contributor to the growth of the US stock market. Firms like Apple, Microsoft, and Google have continued to dominate the market, thanks to their innovative products and strong financial performance. These tech giants have not only driven stock prices but have also set the tone for the rest of the market.

Risk of Market Volatility

While the outlook on US stocks seems positive, it's important to recognize that market volatility is always a possibility. Historically, the stock market has experienced periods of significant volatility, and there's no guarantee that the future will be any different. Investors need to be prepared for sudden market fluctuations and understand the importance of diversification.

Impact of Global Events

Global events, such as trade wars and geopolitical tensions, can have a significant impact on the US stock market. The recent trade disputes between the U.S. and China have caused concerns about global economic stability and have affected investor sentiment. It's crucial for investors to stay informed about these events and their potential implications.

Case Studies: Netflix and Tesla

To illustrate the potential impact of global events on the US stock market, let's take a look at two case studies: Netflix and Tesla.

Netflix: The streaming giant has seen its stock soar in recent years, but it's not without its challenges. In 2019, Netflix faced a significant decline in its stock price due to subscriber growth concerns and increased competition from rival streaming services. However, the company has since recovered, thanks to its continued innovation and strong performance.

Tesla: The electric vehicle manufacturer has been a controversial yet influential player in the stock market. Tesla's stock has experienced massive volatility, with periods of significant growth followed by steep declines. The company's ability to meet production targets and achieve profitability will be key factors in determining its future stock performance.

Conclusion

The outlook on US stocks is promising, with strong economic growth, corporate profits, and innovative companies leading the charge. However, investors need to be prepared for potential market volatility and the impact of global events. By staying informed and remaining diversified, investors can navigate the complexities of the stock market and achieve long-term success.

so cool! ()

like

- Upgrade Your AT&T Stock Alcatel 5041c with the Perfect ROM

- US Stock Calendar 2021: Key Dates and Events You Can't Miss

- Maximizing Returns with US Direct B Stock Investing

- Buy Us Stocks from Overseas: A Guide to Global Investment Opportunities

- How Did the US Stock Market Close Today? A Comprehensive Summary

- Unlocking Investment Opportunities: US Companies on the London Stock Exchange

- "radient technologies stock us: A Deep Dive into RTK's Market Perfo

- Kirkland Lake Gold Stock Price: A Deep Dive into the US Market

- "Top US Integrated Energy Industry Stocks to Watch in 2023"

- "In-Depth US Bancorp Stock Analysis: Potential Gains and Risks"

- Stock Market Performance During the 2016 US Election: Unraveling the Dynamics

- US Senators Stocks: The Intriguing Connection

hot stocks

Pre-Market US Stock Movers: Key Insights and A

Pre-Market US Stock Movers: Key Insights and A- Pre-Market US Stock Movers: Key Insights and A"

- Among Us Christmas Stockings: Uniquely Celebra"

- Samsung Note 12.2 P900 Stock ROM US: A Compreh"

- Total Market Capitalization of US Stocks: A Co"

- "Unveiling the Excitement of US New S"

- Buy Stocks Outside US: A Guide to Global Inves"

- Best Widow and Orphan Stocks in the US Now: To"

- Unlocking the Potential of US Industrials Stoc"

recommend

Upgrade Your AT&T Stock Alcatel 5041c

Upgrade Your AT&T Stock Alcatel 5041c

Is Samsung Stock Traded in the US?

Best Momentum Stocks US Large Cap October 2024

"Ring Fit Adventure: Unveiling the US

Minimum Investment in US Stock Market: Strateg

How to Find New IPO Stocks in the US: Your Ult

Stocks in US Today: Top Picks and Market Trend

Understanding the US OTC Stock Market: A Compr

1917 US Rifle Stock 3-GMK Inspector: A Compreh

Exploring the Labu US Stock Market: Opportunit

Trump's Tariff Exemptions Boost US Stocks

tags

-

AllegedNon-USOpenHolidaysDelekSmallPurchaseBYDEarthClosedGoldEssentialCanTomorrowLNGChineseComprehensUnderstaGrowingRareFuturesAprilHolSchwabManyJonesDefinitiofromIndianMFCDaysTotalFoodSixth-GenerBogleheFallCitizensNintendoDidListTimings100verutodshareamerican10miniliveShausaTarCleanasdaqequityratioTraPriLucrRegSmarspreadHoldingToOptCom2022UnveilinaverageUndertodayFuCorreTradETPharmacequantitativeGaFuturSustainaAvGuidWhisBroadcFindLloanEarningcolacoca us stocks games silver etf us stock

like

- Top Performing US Stock Sectors in 2025: A Com"

- Fear and Greed Index: A Key Indicator for the "

- Unlocking the Potential of Enphase Energy: A D"

- Small Cap Biotech US Stocks List: Your Guide t"

- In-Depth Analysis of 002293.SZ: A Look into th"

- Good US Stocks to Buy: Top Picks for Investors"

- Is Eagle Pharmaceuticals Listed on US Stock Ma"

- Pre-Market US Stock Movers: Key Insights and A"

- Unlocking the Potential of the BNY Mellon US S"

- Understanding the Stock Market Abbreviation fo"